- The rule: anything that can trigger re-approval must be configuration

- The one-page country configuration worksheet

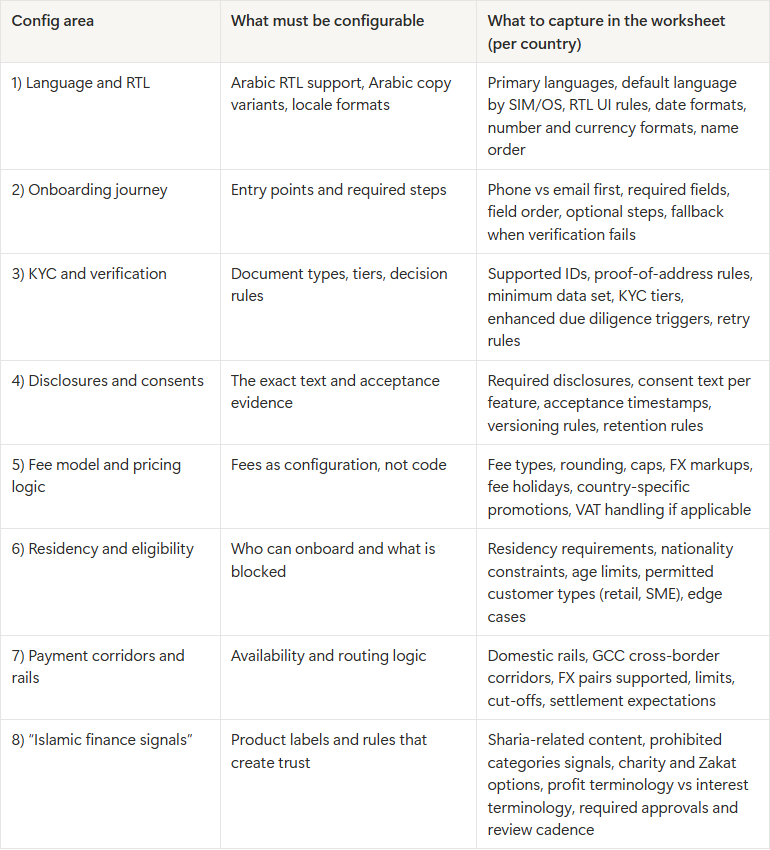

- The config matrix: what must vary per country

- 1) Language and Arabic RTL is not translation, it is layout logic

- 2) KYC variations are rarely one checkbox, they are a decision tree

- 3) Disclosures and consent must be versioned content, not hardcoded screens

- 4) Fee models must be configurable with clear rounding and limits

- 5) Residency constraints and eligibility rules are product rules, not policy text

- 6) Payment corridors: plan for GCC-to-GCC, not just “international transfers”

- 7) “Islamic finance signals” should be configurable content and rules, not a separate roadmap

- The fastest implementation pattern: separate “country profile” from “product core”

- How Finamp supports a GCC-ready configuration approach

If you are building a MENA neobank with UAE as the launchpad, your biggest speed lever is not “more features.” It is making the right things configurable before you add a second country.

Teams lose months because they hardcode assumptions about onboarding, KYC, disclosures, fees, and payment availability. Then a partner in KSA or Bahrain asks for changes that are not “content changes,” they are product rewrites.

This quick reference gives you a practical GCC expansion configuration matrix you can use immediately. Think of it as the minimum set of levers you should be able to switch per country from day one.

The rule: anything that can trigger re-approval must be configuration

A simple filter helps you decide what belongs in configuration, not code:

If changing it would require stakeholder sign-off (compliance, legal, sponsor bank, Sharia review, payments partner), it must be configurable.

That includes obvious items like language, KYC and disclosures, but also the quiet killers: corridor availability, residency constraints, and “Islamic finance signals” that affect trust.

The one-page country configuration worksheet

Below is the worksheet structure (the downloadable version is a one-page matrix you can fill in per country).

How to use it

- Create one “country profile” per market (UAE, KSA, Bahrain, Qatar, Kuwait, Oman).

- Fill each row with the exact settings, content, and partner constraints.

- Treat “Unknown” as a risk. If a row is unknown, it is a dependency that can block launch.

The config matrix: what must vary per country

You do not need all of these to be “dynamic” on day one. You do need them to be changeable without rebuilding core flows.

1) Language and Arabic RTL is not translation, it is layout logic

Arabic RTL affects layout, typography, mirroring, punctuation, and mixed-direction strings (English merchant names inside Arabic UI). Treat RTL as a first-class configuration, not a UI skin.

What to make configurable:

- RTL enablement by locale

- language fallback rules (Arabic first, English second)

- local formatting (dates, numbers, currency)

- content variants per country (not all Arabic is identical across markets)

Practical build guidance:

- Follow W3C requirements for Arabic-script layout and bidi handling. (W3C Arabic layout requirements) and (W3C RTL tutorial)

If you get RTL wrong, onboarding does not just look “off.” It looks untrustworthy.

2) KYC variations are rarely one checkbox, they are a decision tree

Founders often assume “KYC is the same everywhere.” In practice, what changes per market is the decision logic: what documents are accepted, what data is mandatory, when to escalate, and what to do when verification fails.

Make these configurable:

- accepted document sets and fallback documents

- tiering rules (basic vs enhanced)

- rejection and retry logic (how many attempts, what messages)

- risk triggers (PEP matches, unusual patterns, sanctions hits)

Use FATF recommendations as the baseline for risk-based thinking, then adapt per market and partner requirements. (FATF Recommendations)

3) Disclosures and consent must be versioned content, not hardcoded screens

Disclosures do not just “exist.” Under scrutiny you need to prove what a user saw and accepted, and which version was active at the time.

Your configuration worksheet should capture:

- the full text per disclosure (per country)

- when it applies (feature-gated rules)

- acceptance evidence requirements (timestamp, app version, consent version)

- retention expectations and access for support teams

If you cannot reproduce the exact disclosure version from six months ago, you will struggle during partner diligence or complaint resolution.

4) Fee models must be configurable with clear rounding and limits

In multi-country launches, pricing is never “set once.” Partners change fees, business teams run local campaigns, and different corridors require different fee structures.

Configuration needs to cover:

- fee type and trigger (transfer, FX, card usage, inactivity)

- rounding and caps (the details that cause disputes)

- per-corridor fees vs global fees

- promotional overrides (time-bound and country-bound)

The biggest pitfall is hiding fee logic inside payment routing code. Keep routing and pricing separate so you can change one without breaking the other.

5) Residency constraints and eligibility rules are product rules, not policy text

GCC launches often involve eligibility constraints that affect onboarding, servicing, or product access. Even if your legal setup is UAE-first, eligibility logic still needs to be country-configurable because your partner stack will vary.

Capture per country:

- who can onboard (resident, non-resident, GCC national, expat)

- minimum age

- permitted customer type (retail only vs SME)

- blocked scenarios (for example, certain countries of residence)

This is not about listing regulations in a blog post. It is about ensuring you can implement and adjust rules without a rebuild when partner requirements change.

6) Payment corridors: plan for GCC-to-GCC, not just “international transfers”

A common GCC expansion killer is building transfers as “domestic plus SWIFT.” Gulf users and businesses often care about regional corridors and predictable settlement experiences.

One regional element worth understanding is AFAQ, a GCC RTGS system intended to connect member states’ RTGS systems and enable cross-border transfers with settlement finality. (Gulf Payments AFAQ) and (CBUAE AFAQ overview) and (SAMA AFAQ rulebook)

In your worksheet, capture:

- which corridors are available at launch (UAE to KSA, UAE to Bahrain, etc.)

- supported currencies and FX pairs

- limits and cut-offs

- routing priority (domestic rail, regional corridor, international fallback)

This stops your roadmap from being hijacked by “we need GCC-to-GCC next month” emergencies.

7) “Islamic finance signals” should be configurable content and rules, not a separate roadmap

Even when you are not offering full Islamic banking products on day one, users read signals. Language, labels, and controls can either build trust or create friction.

Examples of signals that should be configurable:

- terminology choices (profit vs interest language where appropriate)

- optional charity and Zakat-related features (if relevant to your audience)

- merchant category signals or spending insights aligned with Sharia sensitivities (handled carefully)

- disclosure text that clarifies how the product operates

The right approach is not “guess Sharia.” It is to design a content and approval workflow: what requires Sharia review, who signs off, how often content is reviewed.

For standards references, AAOIFI publishes Shari’ah standards used as guidance or adopted in some contexts. (AAOIFI Shari’ah Standards) The IFSB also issues guidance on Sharia governance and conduct principles. (IFSB publications)

The fastest implementation pattern: separate “country profile” from “product core”

If you want speed across UAE, then KSA, then Bahrain, design two layers:

- Product core: account model, ledger logic, transaction lifecycle, audit trail.

- Country profile: language, onboarding rules, KYC decision tree, disclosures, pricing, eligibility, corridors, Sharia signals.

When country differences live inside the core, every new market becomes a rewrite.

How Finamp supports a GCC-ready configuration approach

Finamp is built for teams launching across multiple countries with UAE often as the starting point. The platform approach is configuration-first: you define country profiles and adjust onboarding, KYC rules, disclosures, fee logic, eligibility constraints, corridor availability, and culturally-aware content without rebuilding the product core each time.

Finamp’s teams have experience supporting DFSA and SAMA-aligned delivery expectations, which helps when your expansion plan includes both UAE routes and Saudi growth. The practical benefit is speed with control: you can tailor the product per market while keeping auditability and operational clarity consistent across the region.